Introduction

Insurance plays a critical role in protecting individuals and businesses from unforeseen risks. Staying updated on insurance news is essential for policyholders, industry professionals, and anyone interested in understanding how the insurance landscape is evolving. This article delves into the latest trends, types of insurance, and why staying informed is vital.

What Is Insurance?

Insurance is a financial arrangement that provides protection against potential future losses. In exchange for regular premium payments, insurance companies offer financial compensation for covered events, such as accidents, health issues, or property damage. The primary types of insurance include:

- Health Insurance

- Health insurance covers medical expenses, including hospital visits, surgeries, and prescription medications. It is crucial for managing healthcare costs and ensuring access to necessary treatments.

- Auto Insurance

- Auto insurance protects drivers against financial loss in the event of accidents, theft, or damage to vehicles. Coverage options vary widely, influencing premiums and protection levels.

- Homeowners Insurance

- This type of insurance safeguards homes and personal belongings against risks like fire, theft, and natural disasters. Homeowners policies can also cover liability for injuries that occur on the property.

- Life Insurance

- Life insurance provides financial support to beneficiaries upon the policyholder’s death. It is a crucial tool for estate planning and ensuring loved ones are financially secure.

- Business Insurance

- Business insurance protects companies from potential losses due to various risks, including property damage, liability claims, and employee-related issues. Different policies cater to specific business needs.

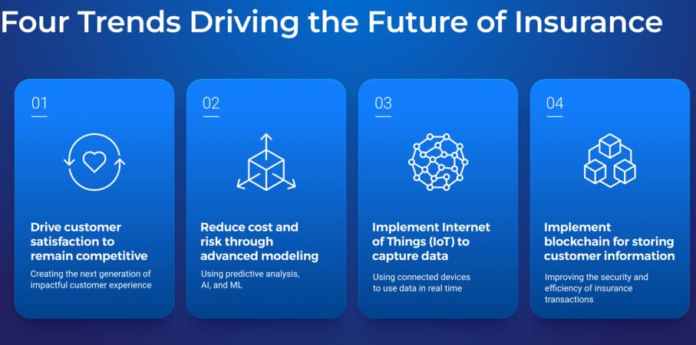

Current Trends in Insurance News

- Digital Transformation

- The insurance industry is increasingly leveraging technology, such as artificial intelligence and big data, to streamline processes, enhance customer service, and improve risk assessment.

- Telematics in Auto Insurance

- Usage-based insurance models, where premiums are determined by driving behavior, are gaining popularity. Telematics devices monitor speed, braking, and other driving habits to adjust premiums accordingly.

- Climate Change and Insurance

- Insurers are adapting to the rising risks associated with climate change. This includes re-evaluating coverage for natural disasters and implementing sustainable practices within the industry.

- Health Insurance Innovations

- With the rise of telehealth services, health insurance providers are expanding coverage options to include virtual consultations and remote monitoring technologies.

- Regulatory Changes

- The insurance industry is subject to various regulations that can impact policy offerings and pricing. Keeping abreast of these changes is essential for both consumers and professionals.

Why Insurance News Matters

- Informed Decision-Making: Understanding the latest trends and changes in insurance can help consumers make informed choices about their coverage options.

- Risk Management: Awareness of current risks, such as cyber threats or climate-related issues, enables individuals and businesses to better manage their insurance needs.

- Cost Savings: By staying updated on industry trends, consumers can take advantage of new policies and discounts that may lower their premiums.

- Regulatory Awareness: Knowledge of regulatory changes can help policyholders understand their rights and obligations, ensuring compliance and protection.

Conclusion

Staying informed about insurance news is essential for anyone looking to navigate the complexities of coverage options and industry trends. Whether you are a policyholder, an industry professional, or someone interested in financial planning, understanding the insurance landscape will help you make better decisions and protect your assets.

Subscribe to our newsletter to receive the latest updates in insurance news and explore resources that will enhance your understanding of coverage options and industry developments.